Simple Ira Limits 2025. To roll over your 401 (k) to an ira, you must choose an ira account type and provider and initiate the rollover. 2025 health savings account (hsa).

In 2025, employees can contribute $16,000 into their simple ira, which is up from the 2025 simple ira limit of $15,500. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000.

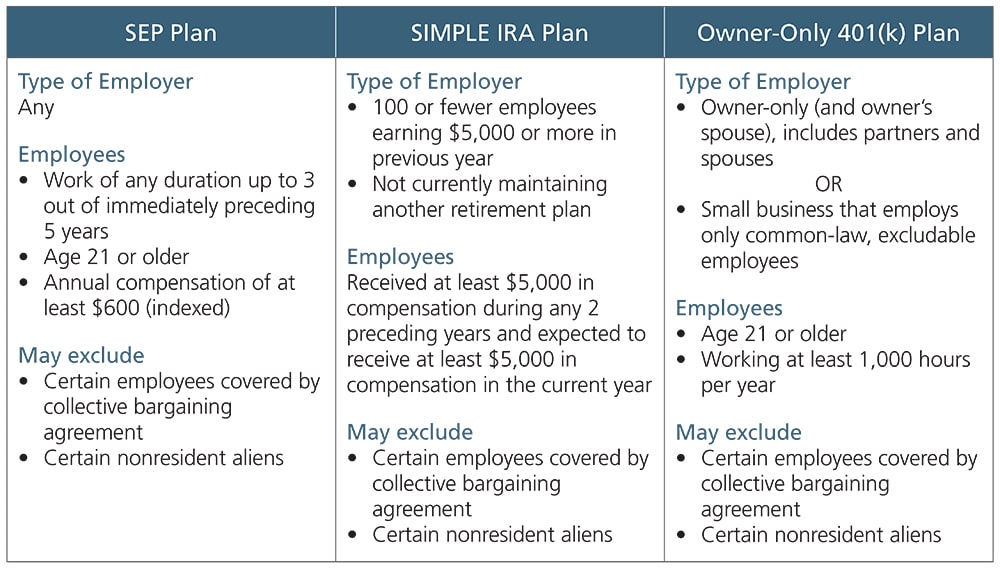

If an employer had 24 employees for 2025, and the number of employees increased to 25 in 2025 and 2026, they can continue to apply the.

For tax year 2025, the maximum ira deduction is $7,000 for people younger than 50, and $8,000 for those 50 and older.

simple ira contribution limits 2025 Choosing Your Gold IRA, 4 steps to roll over a 401 (k) to an ira. The simple ira contribution limit for the 2025 tax year is $15,500, meaning employee salary deferral.

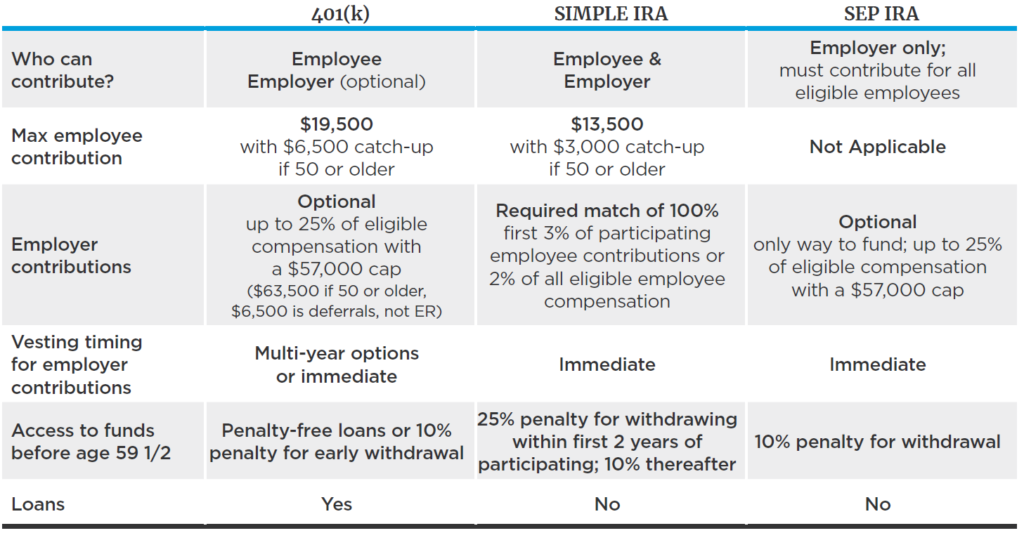

Discover the Benefits of Establishing a 401(k) over a SEP or Simple IRA, Participants in simple 401 (k) and simple ira plans can take advantage of an increased deferral limit of $17,600 (i.e., 110% of the $16,000. Below are the simple ira contribution limits for employees and.

IRA Contribution and Limits for 2025 and 2025 Skloff Financial, Below are the simple ira contribution limits for employees and. The simple ira contribution limit for the 2025 tax year is $15,500, meaning employee salary deferral.

IRA Contribution Limits 2025 Finance Strategists, Washington — the internal revenue service announced today. For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025.

simple ira 2year rule exceptions Choosing Your Gold IRA, Those numbers increase to $16,000 and $19,500. If an employer had 24 employees for 2025, and the number of employees increased to 25 in 2025 and 2026, they can continue to apply the.

IRA Contribution Limits in 2025 Meld Financial, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000.

Simple IRA vs 401k Choose The Right Plan For Your Business, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025. To maximize deductions in a.

SIMPLE IRA Contribution Limits in 2016 TS Associates, The annual employee contribution limit for a simple ira is $16,000 in 2025 (an increase from $15,500 in 2025). 2025 health savings account (hsa).

SIMPLE IRA Contribution Limits 2025, A cash balance plan could allow for contributions as significant as $3 million in 2025, depending on your income and how far you are from your. 4 steps to roll over a 401 (k) to an ira.

SEP IRA The Best SelfEmployed Retirement Account?, See how much you can contribute to an ira this year. The simple ira contribution limit for the 2025 tax year is $15,500, meaning employee salary deferral.

For the 2025 tax year, the irs set the annual ira contribution limit at $6,500 for investors under 50 years of age.